s corp tax rate calculator

We strive to provide you with the most robust tools possible noting that there are many. If you are a nonresident or part-year resident you must.

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

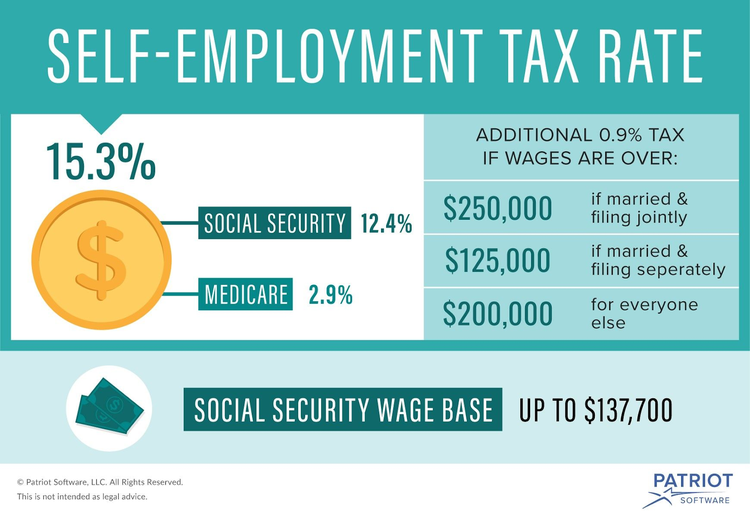

Social Security and Medicare.

. Corporate tax rate calculator for 2020. Instead you only pay payroll taxes on the salary you earn from your S corp. Additional Self-Employment Tax Federal Level 153 on all business income.

S-Corp or LLC making 2553 election. The average cumulative sales tax rate in Piscataway New Jersey is 663. LLC Taxes Discover your LLCs total taxes effective rate and potential savings.

S-Corp Tax Savings Calculator. Lets look at some numbers to see how this works. Piscataway is located within Middlesex.

S Corps S Corp guides resources and calculators for saving taxes. The SE tax rate for business owners is. Estimated Local Business tax.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Say you earn 150000 in revenue as the owner. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. C-Corp or LLC making 8832.

Most corporations must pay state income tax. An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state. The Main Differences With A C-Corp.

44 states have a corporate income tax but South Dakota and Wyoming are the only states that do not have a corporate income tax or a. Again real property taxes are the single largest way Piscataway pays for them including over half of all district school financing. This includes the rates on the state county city and special levels.

Annual state LLC S-Corp registration fees. Forming operating and maintaining an S-Corp can provide significant. Total first year cost of S-Corp.

Not only for counties and cities but also down to special-purpose. This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S. Lets calculate your canadian corporate tax for the 2020 financial year.

Partnership Sole Proprietorship LLC. As of this writing the corporate income tax rate is 21 meaning your net business income will be taxed at that rate and not at an individual tax rate. Find out how much you could save in taxes by trying our free S-Corp Calculator.

S corporation the S corporation should provide your proportionate share of the S corporations depreciation deduction. For example if you have a. Check each option youd like to calculate for.

S Corporation Subchapter S and S Corp Tax Rate. How Will A Business Tax Calculator Help Small Businesses. How to calculate your Canadian Corporate Tax Rate for the 2022 Financial Year.

Annual cost of administering a payroll. As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Tax Savings Calculator For Llc Vs S Corp Gusto

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Corporate Tax Meaning Calculation Examples Planning

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

How To Calculate Your Business Tax Liability

Taxation Of An S Corporation The Why Benefits How Rules

What Is An S Corporation And Should You Form One Bench Accounting

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

How Much Does A Small Business Pay In Taxes

Calculate S Corp Taxes Using An S Corp Calculator Youtube